Given the high-risk seismic zone encompassing much of the state coupled with a history of devastating temblors delivering billions in past property damages, many California homeowners wonder – “is earthquake insurance required in California” by mortgage lenders backing property investments or by state regulations mandating coverage for residents?

The answer is no – California currently does not universally force property owners in known earthquake zones participate in hazard protection programs designed limiting personal losses and collateral damage risks as compulsory policy measures. However, certain situational requirements and financial advisability still compel consideration from at-risk homeowners despite no blanket coverage obligation statewide.

Key Earthquake Insurance Policy Standards in California

While California avoids statewide compulsory inclusion desperately needing revision after demonstrating vulnerabilities through recent seismic incidents taxing inadequately covered residents and communities, noteworthy program dynamics still apply:

CA Earthquake Authority (CEA) – The not-for-profit, state-run insurance company provides residential earthquake policy options for homeowners separate from standard private market homeowner insurance packages still requiring supplementation above bare minimums. CEA coverage works with high deductibles averaging 15% of losses.

Homeowner Policy Limits – Ordinary property insurance policies sold by major carriers often contain “earth movement” exclusions meaning owners still bear financial responsibility for quake damages despite paying annual premiums protecting structures from other covered losses. Many assume false coverage.

Mortgage Lender Requirements – Depending on property seismic risk mapping, if choosing purchasing homes without earthquake endorsements, lenders frequently mandate either securing coverage separately or maintaining minimum dedicated loss funds through impound escrow accounts guaranteeing ability to finance reconstruction if structures collapse.

So in essence, the direct answer to “is earthquake insurance required in California” depends on whom you ask given conflicting interests of state governance, insurance industry limitations, and mortgage financiers overseeing collateralized asset risks – but ultimately no current laws explicitly mandate uniform homeowner coverage compliance. Gaps require better consumer protections however based on expectations.

Should Earthquake Insurance Become Required by Law in California?

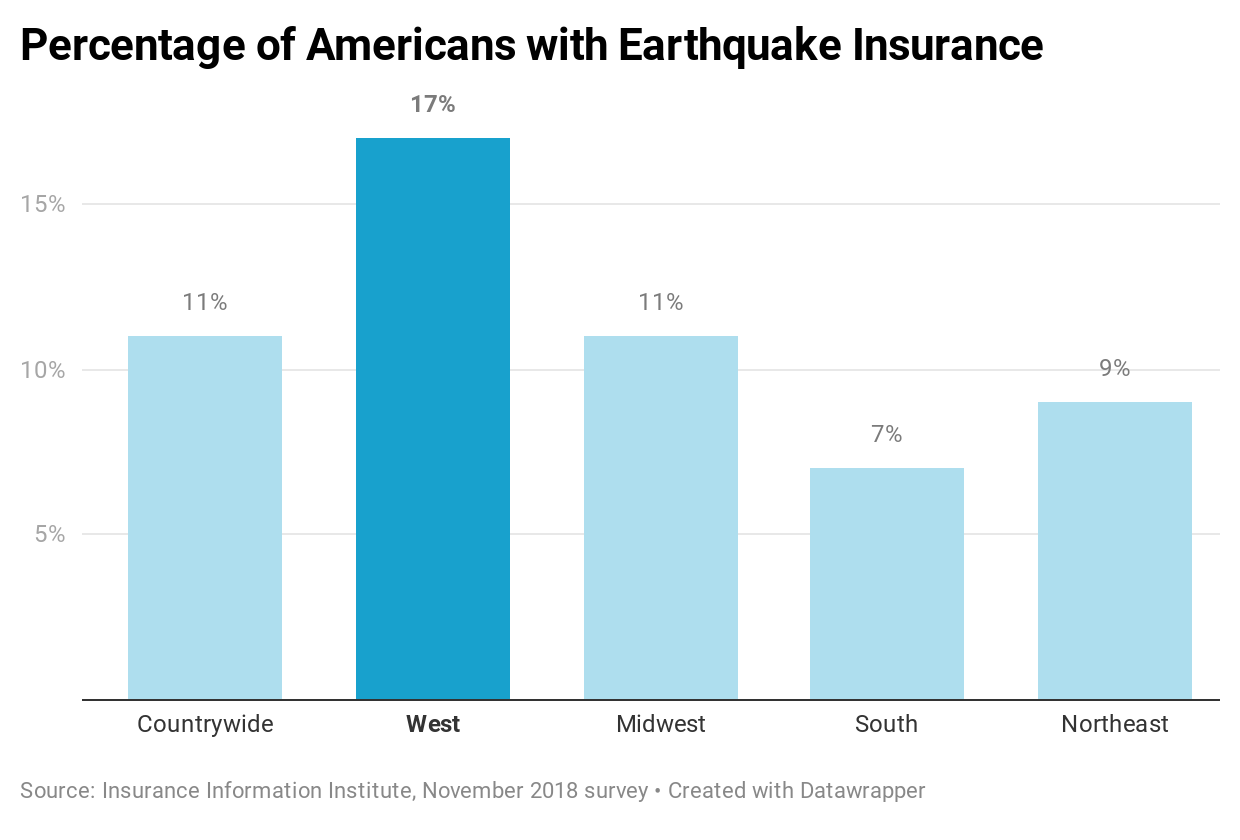

Given geographic realities involving major fault lines running through densely populated zones of California directly threatening millions of properties with episodic devastation despite state-of-the-art structural engineering safeguards implemented in recent building codes, many experts argue compulsory earthquake insurance akin to mandatory flood insurance adopted in risky FEMA regions serves as the only policy solution aligning economic resilience priorities fairly for both individual homeowners plus communities statewide sharing everybody’s best interests.

Potential counterarguments involving fears that across-the-board compulsory insurance erects expensive barriers making homebuying unaffordable for lower-middle income groups accurately justified perhaps require creative solutions averting problems faced whenever societies share natural disaster risks collectively demanding universal contributions into pooled resources offsetting mega-losses equitably.

No perfect options exit debating “to mandate or not mandate earthquake insurance inclusion” but ignoring status quo gaps failing citizens when catastrophic events test disaster preparedness seems no longer acceptable reaction either for vulnerable California based on expectations from residents seeking more reliable safeguards relative to true hazard probabilities they face residing around active geologic threats recognized.

Insurers themselves continue resisting compulsory participation policies given the sheer potential fiscal liabilities associated with entire regions facing claims inundation simultaneously. But shared risk and governance transparency principles argue progressing towards some middle ground compromise serves public interest more effectively than current inconsistent patchwork earthquake insurance policy positions government and private sector players adhere to now.