No parents like pondering devastating losses of children. But as guardian stewards managing family affairs thoughtfully means prudently addressing “how much life insurance do I need for my child” in case unthinkable tragedy struck. Matching affordable coverage protecting survivors financially makes sense.

Sadly, around 53,000 youth ages 0-19 die annually in America according to CDC data. Leading causes include congenital abnormalities, accidents/injuries, cancer, heart conditions, and suicide. While rare statistically, plunged into grieving those losses without financial preparations compounds hardships enormously for parents and siblings left behind.

What Child Life Insurance Covers

Child life insurance policies work similarly to ordinary coverage for adults – paying lump-sum death benefit proceeds requested by beneficiaries to help cover:

- Funeral, burial and memorial service expenses

- Estate administration fees like probate court processes, executor and attorney costs

- Outstanding medical bills or student loans left unpaid

- Lost potential income that would have provided for survivor family needs

- Charitable gifts honoring the deceased child’s legacy

- Other financial support areas parents identify

While no amounts restore precious life losses, child policies ease Manage financial stressors preventing properly honoring children amid despairing family tragedies. It’s a prudent cushion.

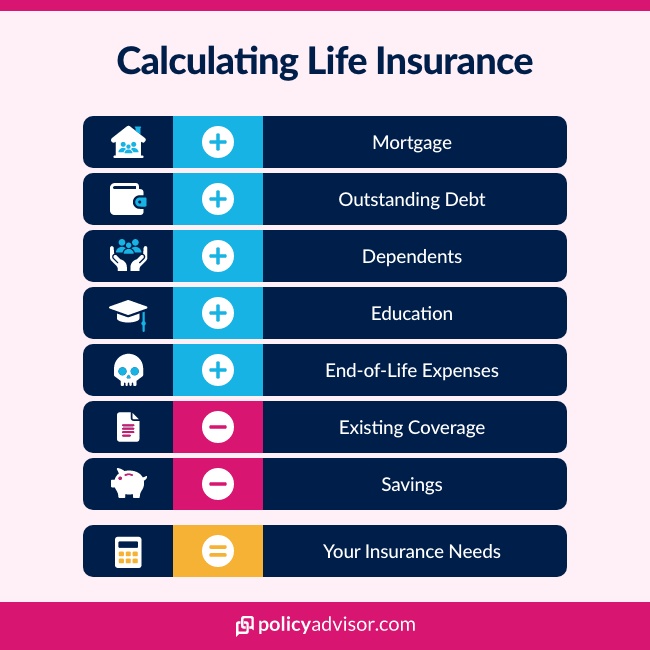

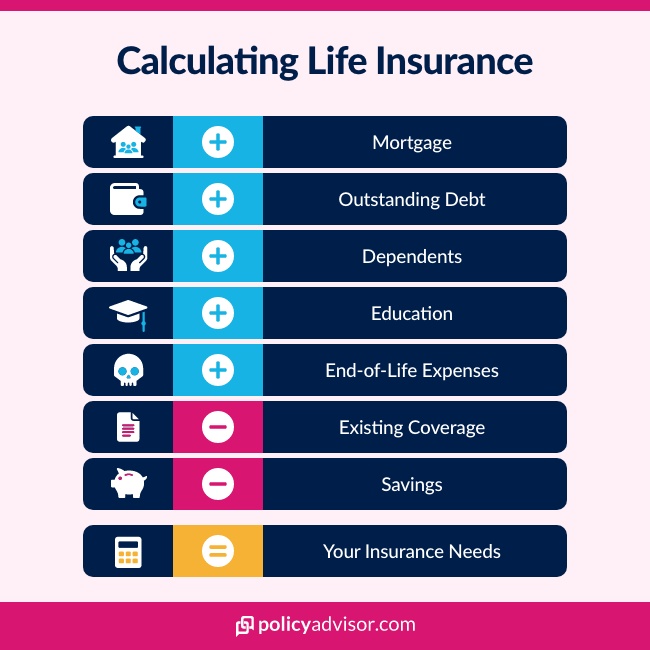

Calculating Coverage Amounts Needed

Common guidance on how much life insurance to buy for kids suggests securing 10-20x anticipated annual income earnings they may have provided to survivors needing support later in life. But many factors determine sound coverage levels for children:

Funeral Expenses – Costs range widely from $7,000 – $12,000+ on average for services, cemetery plots, caskets, headstones and remembrance gathering events. Cremations cost less but families may augment spending toward memorials.

Household Income – If dual-earning parents require replacing potential lost wages for leave time around making arrangements and managing grief, small policies can assist temporarily.

Charitable Contributions – Covering sizable donations toward causes close to the deceased child’s interests means budgets need alignment.

Existing Assets/Debts – High net worth families with abundant estate assets may simply need lower coverage policies than lower-middle income parents carrying more debt needing payout proceeds to settle unpaid balances.

Number of Surviving Children – Losing an only child carries different financial needs compared to bigger families with multiple kids. Income protection gaps shrink slightly across more remaining siblings.

Comparing quotes across a range of potential payout options from $25,000 up to $100,000 coverage for example allows parents to balance affordability against household financial obligations needing support. Many parents elect $50,000 policies to compromise their children’s coverage.

Purchasing Child Life Insurance Policies

Several policy considerations shape purchasing decisions:

Type – Term or whole life insurance choices apply depending on budget, age of kids and length of coverage timeframes. Convertible term policies allowing switching to permanent coverage as kids enter adulthood provide flexibility. Shop carefully.

Health History – Unlike adult policies requiring medical exams, most child policies limit health questions to simplify purchase processes during emotional periods for grieving parents.

Rider Add-Ons – Accelerated death benefit riders are commonly recommended to access 50% of death payout amounts early if confirming terminal illness diagnoses to pay for experimental medical treatments unavailable via standard health insurance.

Bundling With Parent Policies – Adding child policies as term riders on parents’ existing coverage sometimes delivers discounted pricing while consolidating household coverage efficiently on one bill.

While devastating to ponder, prudently addressing “how much life insurance for kids” questions now during younger ages with good health offers easiest protection steps preventing added financial turmoil compounding unimaginable loss trauma later. Acting in their best interests responsibility means considering worst-case scenarios realistically so survivors don’t endure preventable money struggles spiraling amid despair.